Examining Your Credit History

Credit reporting companies:

- Experian (800) 682-7954 www.experian.com

- Equifax (800) 685-1111 www.equifax.com

- TransUnion (800) 888-4213 www.transunion.com

www.freecreditreport.com

www.creditreports.com

What if I find a mistake in my credit history?

You can correct simple mistakes by writing to the reporting company, pointing out the error, and providing proof of the mistake. You can also request to have your own comments added to explain problems. For example, if you made a payment late due to illness, explain that for the record. Lenders usually understand about legitimate problems.

What about my overall (or FICO) score? What does it mean?

Prior to the late 1990s, credit scoring had little to do with mortgage lending. When reviewing your credit worthiness, an underwriter would make a subjective decision based on past payment history. Then things changed.

Prior to the late 1990s, credit scoring had little to do with mortgage lending. When reviewing your credit worthiness, an underwriter would make a subjective decision based on past payment history. Then things changed.

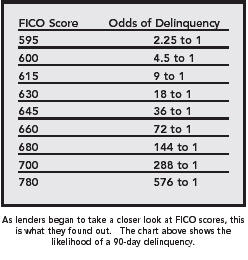

Lenders studied the relationship between credit scores and mortgage delinquencies and found a definite relationship. Almost half of those borrowers with FICO scores below 550 became ninety days delinquent at least once during their mortgage. On the other hand, only two out of every 10,000 borrowers with FICO scores above eight hundred became delinquent.

When can I stretch the percentages?

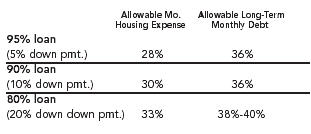

Depending on your area's housing market, lenders sometimes will allow you to stretch their allowable debt ratios. One of the best ways to encourage your lender to do so is to increase your down payment, as indicated in the following chart:

Allowable Monthly Housing Expense

Underwriters sometimes also will stretch the ratios for other "compensating factors," including:

- Strong cash reserves after close of escrow

- A new payment that’s only slightly higher than current rent or mortgage payment

- A history of increasing earning capabilities

- A history of an ability to save money

- A large cash down payment

Courtesy of Sonata Realty